What Happens To Joint Property When A Spouse Dies

If you own real estate a bank account an investment account a vehicle or other property with your spouse as joint tenants with rights of survivorship sometimes abbreviated as JTROS and one of you dies the other becomes the sole owner of the asset. Couples commonly own property jointly with the right of survivorship.

Financial Checklist 13 Things You Need To Do When Your Spouse Dies Principal

This is not affected by a will or the intestacy rules.

What happens to joint property when a spouse dies. Going through the process of dividing the joint trust at the first spouse death would save 50000 in estate tax that could be passed on to the spouses. Any asset that is titled to a husband and wife jointly joint with right of survivorship JWROS or as tenants by the entirety passes to the wife at the moment of husbands death. One way in which a husband and wife may own property is as joint tenants with rights of survivorship.

This is most common for the marital home. This is because there cannot be a joint estate. When your spouse or partner dies you have a lot to deal with.

Funerals can be costly and without your spouses income you may be struggling to cover your expenses. The law relating to inheritance of a community property on the death of a spouse varies from state to state. It does not pass under the will and title vests in the surviving joint owner immediately.

If you are married in community of property and your spouse passes away the joint estate is dissolved. The 500000 above the Oregon threshold would be taxed at a rate of ten percent. If your spouse dies you usually become the sole owner of any money or property that you both owned jointly.

Therefore probate isnt necessary to retitle the asset. For such property when one spouse dies the property automatically transfers to the surviving spouse. For example you usually have the right to all the money in any joint bank account and you become the sole owner of any real estate that the two of you held in joint tenancy.

In some states the surviving joint owner can simply file a certified copy of the deceased co-owners death certificate. The divorcee then re-marries adds the new spouse as a joint owner of the property and on the divorcees death the new spouse then takes the full benefit from the property. The spouse died intestate in a common-law state and the property was held as a joint tenancy with right of survivorship or a tenancy by the entirety However some married couples can encounter issues when one spouse wishes to give their one-half of community property to someone else that is not their other spouse.

To learn more about how joint ownership of real estate works see Nolos article Joint Property and Concurrent Ownership. This transfer takes place outside the probate process. The statement is often called something like Affidavit Death of Joint Tenant or Affidavit of Surviving Spouse for Change of Title to Real Estate.

In some states it only needs to be signed under. It may need to be notarized in which case its called an affidavit. With survivorship if one of them dies the surviving spouse becomes the sole owner of the property.

You need to put a document on file in the local public land records showing that one joint owner has died and that the surviving co-owner is now the sole owner of the property. Statement signed by the survivor stating that the survivor is now the sole owner of the joint tenancy property. The reason for this occurring is due to the way in which the property is held.

Certified copy of the death certificate. Thus 50000 would be due to the state of Oregon as an estate tax on the surviving spouse death. Even as youre grieving the loss you must keep managing daily tasks like paying the bills.

The rights of survivorship clause affects probate. This is true for both married and common-law couples. Married individuals often hold title to their home as joint tenants with rights of survivorship.

The general idea is the same everywhere however. Usually the assets jointly purchased and earned during the existence of the marriage are considered community property and a married couple share equally in community property. When one spouse dies it automatically transfers title directly to the surviving tenant.

Who Is Responsible For A Mortgage When A Spouse Dies Without A Will Legalzoom Com

The Transfer Of Property Deed Upon A Spouse S Death Legalzoom Com

Taxes After The Death Of A Spouse Marketwatch

What Happens If A Spouse Dies Before The Divorce Papers Are Signed Legalzoom Com

Myth 2 I Don T Have To Plan Because My Spouse Will Get Everything For Many Married Couples It Is Common To Own P Estate Planning How To Plan Married Couple

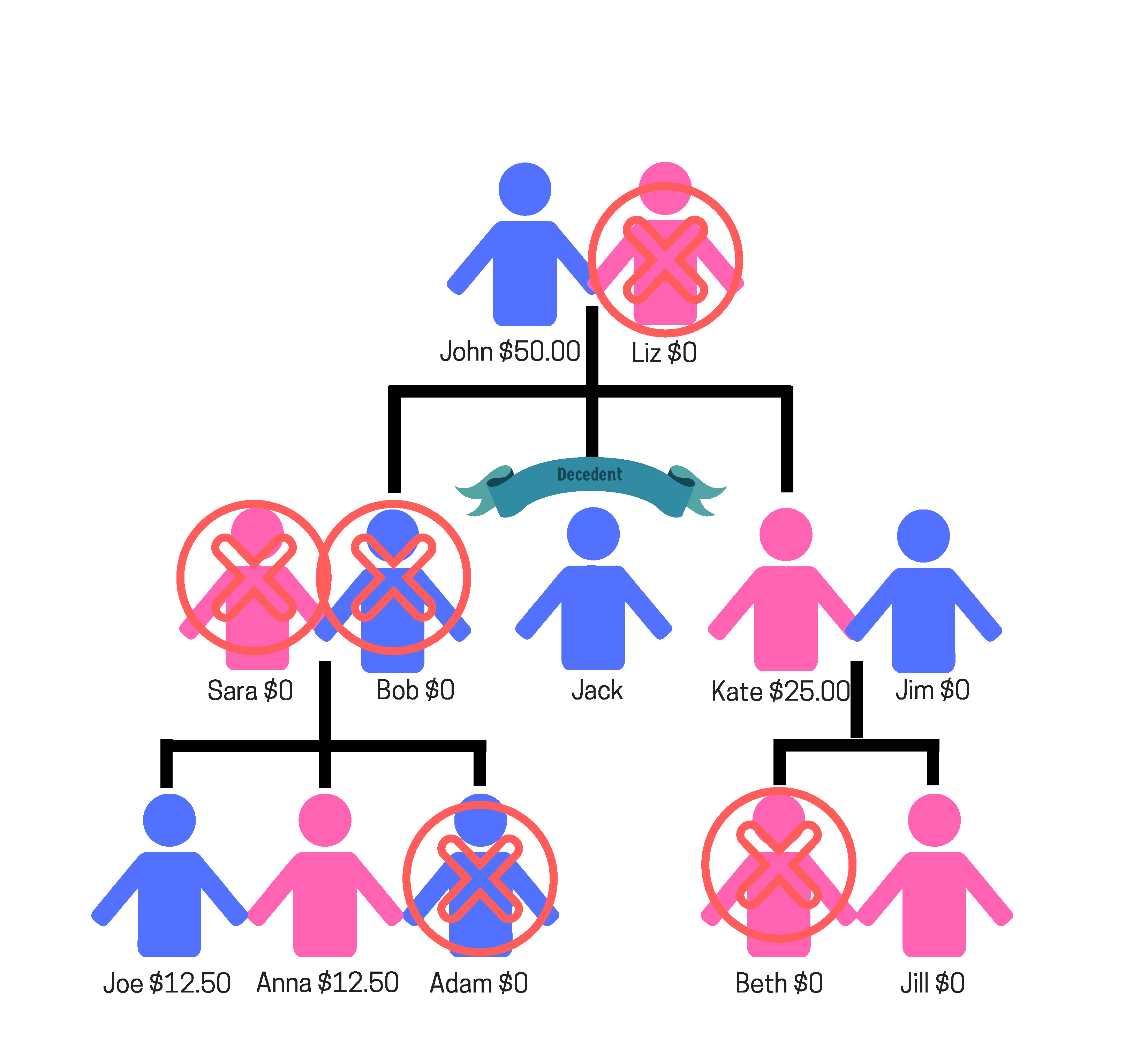

Who Inherits If No Will In Illinois A Guide For Heirs And Executors

What Does A Surviving Spouse Inherit Spencer Law Firm

Should You Remove A Deceased Owner From A Real Estate Title Deeds Com

Pin On Law S Constitutions Of The Philippines

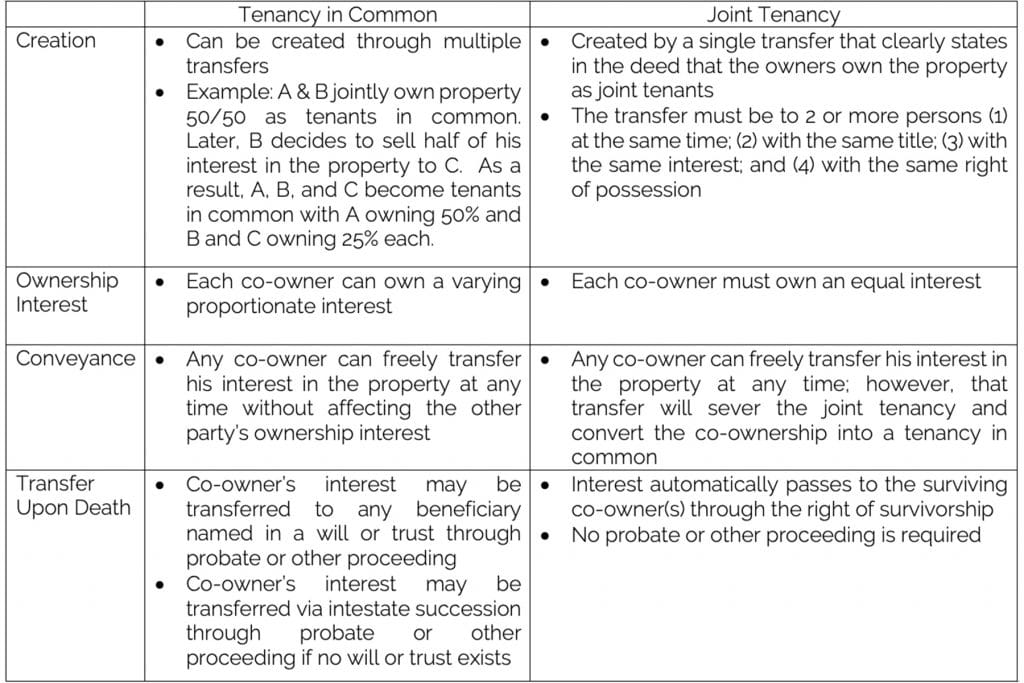

Joint Tenancy Vs Tenancy In Common Schorr Law A Professional Corporation

Pin On Family Code Philippines

Foreigner S Inheritance Measures 5 Advantages To Making A Will In Japan Plaza Homes

Should You Remove A Deceased Owner From A Real Estate Title Deeds Com

Http Www Affirmativeescrow Com Uploads 4 6 8 2 46821611 Joint Tenants Vs Community Property With Rights Of Survivorship Pdf

How To Handle Credit And Debt After The Death Of A Spouse Experian

Find Out If A Revocable Living Trust Is Right For You And How It Works Revocable Living Trust Living Trust Revocable Trust

Should You Remove A Deceased Owner From A Real Estate Title Deeds Com

Most Married Couples Own Their Home Through Joint Tenancy With Rights Of Survivorship Or Tenancy By Th Things To Sell Selling Your House Revocable Living Trust

Post a Comment for "What Happens To Joint Property When A Spouse Dies"